Event-driven Alpha Analysis: Post-Earnings Announcement Drift (PEAD)

Post-Earnings Announcement Drift (PEAD)

The project researched on the effects of announcement on abnormal returns to the excess returns of stocks in the Chinese A-share market.

Findings

The project discovered that:

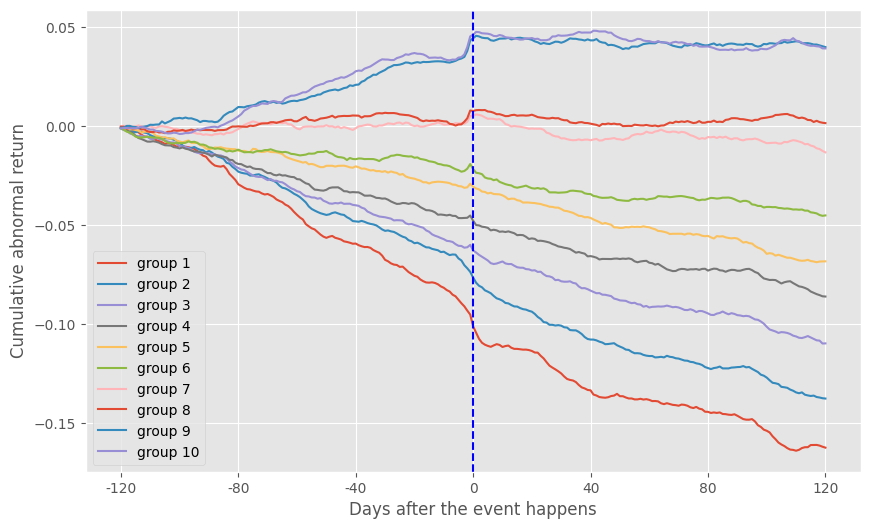

- The ten groups exhibit a pronounced and systematic separation in their Cumulative Abnormal Returns (CARs) throughout the entire event window.

- Price adjustment is not instantaneous after the announcement (inefficiency did exist).

- The significant divergence in CARs before the event date indicates that the market was already pricing in the upcoming positive or negative information.

Simple Alpha Design

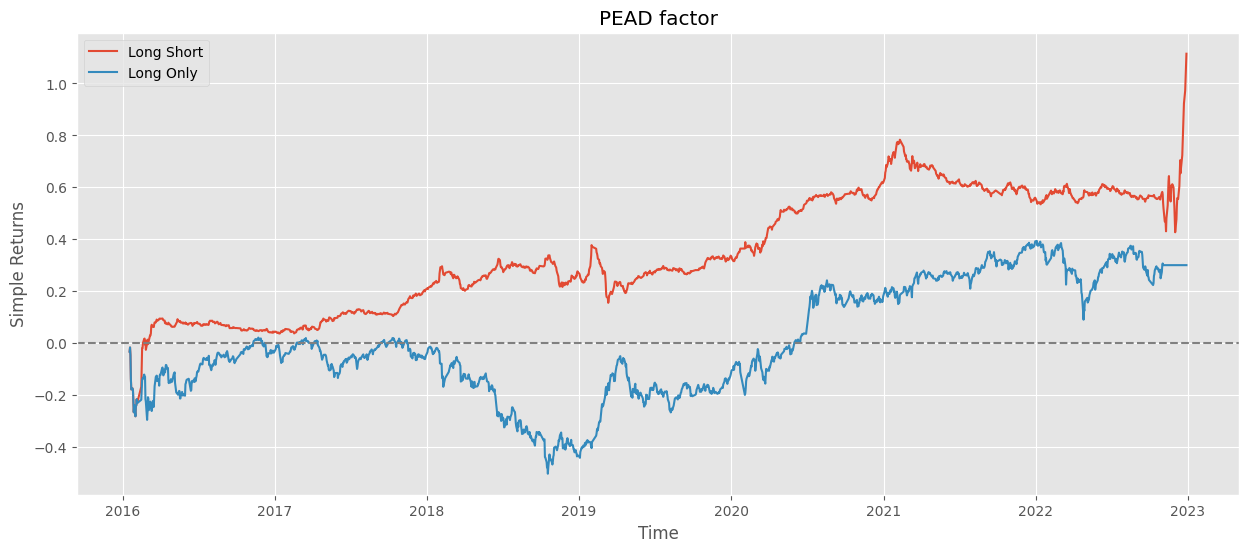

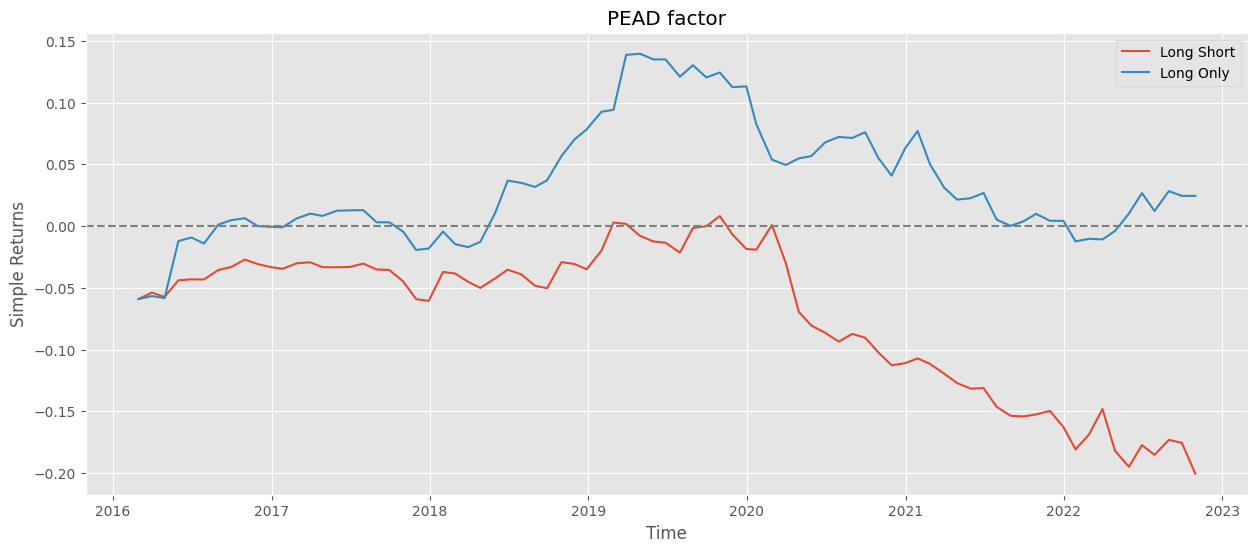

Considering only the two groups with the highest and lowest SUE, we initiate a long/short strategy maintained for 120 days after the announcement:

Only consider the test for HS300 coverage:

Takeaways

The source of returns for the PEAD effect is primarily style rotation/shift, such as transitioning from shorting small-cap, poor-performing stocks to going long on high-quality, large-cap stocks. The risk is mainly contributed by short-selling restrictions and a subsequent style reversal. Therefore, this project also demonstrates that the profit and loss sources of this announcement-based, event-driven alpha are fundamentally the same.